The evolving landscape of employee compensation and taxation in the Philippines has taken a notable step forward with the issuance of Revenue Regulations (RR) No. 029-2025 by the Bureau of Internal Revenue, under the policy authority of the Department of Finance. This regulation introduces long-awaited updates to the ceilings of de minimis benefits, revising thresholds that had remained largely unchanged for years despite inflationary pressures, shifting workforce expectations, and rising costs of living.

For Human Resources leaders, payroll professionals, finance teams, and business owners, RR No. 029-2025 is not a minor administrative adjustment. It reshapes how organizations design benefits, manage payroll tax exposure, communicate compensation policies, and ultimately protect employee take-home pay. This HR Today feature by the International HR Institute provides an in-depth, end-to-end discussion of the regulation, its intent, its practical impact, and the governance responsibilities it places on modern HR functions.

De Minimis Benefits: More Than “Small Perks”

Under Philippine tax rules, de minimis benefits are facilities or privileges of relatively small value granted by employers to employees, which are excluded from taxable compensation provided they fall within ceilings prescribed by the BIR. These benefits were designed to allow employers to extend practical support to employees without triggering income tax or complex withholding computations.

Examples include rice subsidies, uniforms, medical assistance, and modest gifts. While individually small, collectively these benefits form a critical part of many organizations’ total rewards strategies, particularly for rank-and-file and supervisory employees.

However, de minimis treatment is conditional. Once a benefit exceeds its prescribed ceiling, the excess amount loses its tax-exempt character and must be treated under applicable tax rules, often interacting with the “other benefits” threshold or being included in taxable compensation. Misclassification has historically been one of the most common findings during payroll audits and BIR examinations.

RR No. 029-2025 seeks to address this tension by updating ceilings that no longer reflected economic realities.

The Policy Rationale Behind RR No. 029-2025

The issuance of RR No. 029-2025 reflects a broader policy direction: maintaining the relevance of tax-exempt benefits in an environment where prices of food, healthcare, transportation, and basic necessities have steadily increased.

While headline inflation has moderated in recent periods, household expenditure data continues to show that employees feel pressure most acutely in recurring, day-to-day costs. De minimis benefits are uniquely positioned to address these pressures because they are immediately felt by employees and tax-efficient for employers.

Rather than mandating across-the-board wage increases, which carry statutory contributions and tax implications, the updated de minimis framework allows employers to provide targeted relief while maintaining fiscal discipline.

What RR No. 029-2025 Changed: A Detailed Comparison

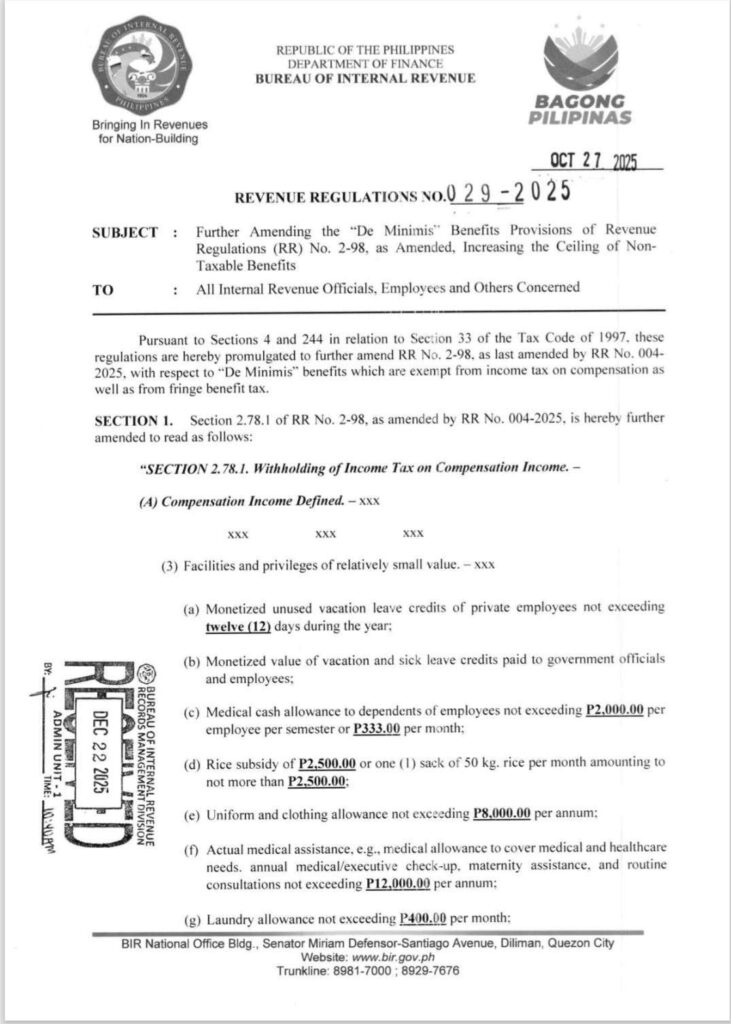

RR No. 029-2025 formally amends the de minimis ceilings previously set under RR No. 2-98, as amended. Below is a detailed comparison of the old limits and the new ceilings now in force under the regulation:

- Monetized unused vacation leave (private employees)

From 10 days per year → 12 days per year, tax-exempt - Medical cash allowance to dependents

From ₱1,500 per employee per semester (₱250/month) → ₱2,000 per employee per semester (≈ ₱333/month) - Rice subsidy

From ₱2,000 per month → ₱2,500 per month, or one 50-kg sack of rice at equivalent market value - Uniform and clothing allowance

From ₱7,000 per annum → ₱8,000 per annum - Actual medical assistance (medical allowance, maternity assistance, executive check-ups, routine consultations)

From ₱10,000 per annum → ₱12,000 per annum - Laundry allowance

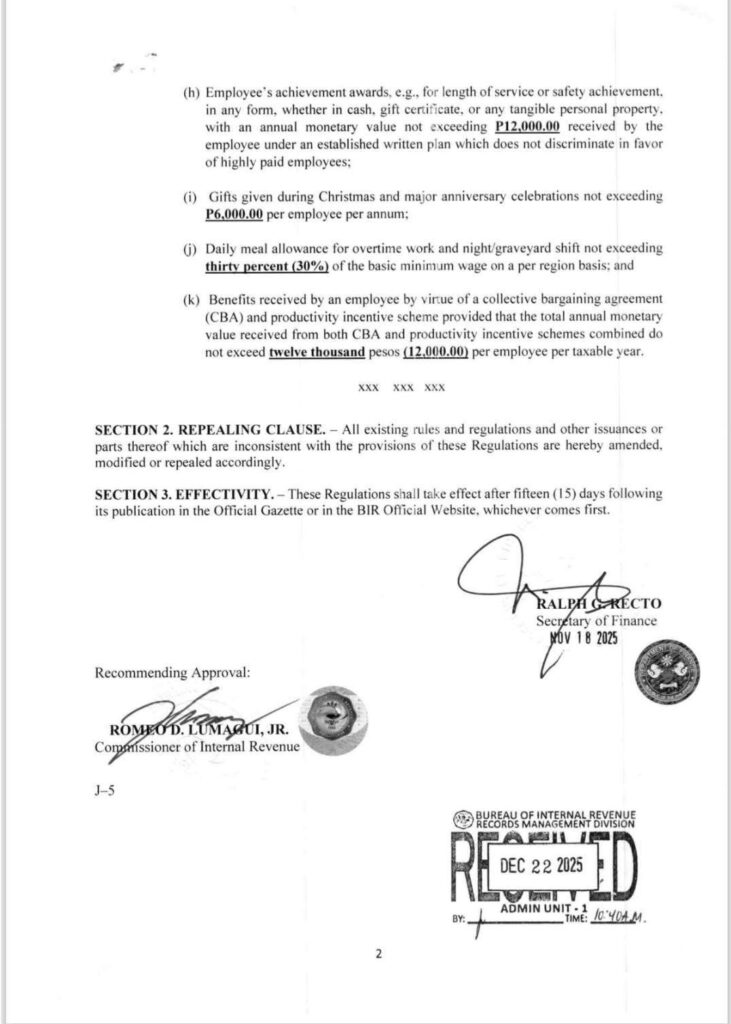

From ₱300 per month → ₱400 per month - Employee achievement awards (under a written, non-discriminatory plan)

From ₱10,000 per annum → ₱12,000 per annum - Christmas and major anniversary gifts

From ₱5,000 per annum → ₱6,000 per annum - Meal allowance for overtime or night/graveyard work

From 25% → 30% of the applicable regional minimum wage - Benefits under Collective Bargaining Agreements and productivity incentive schemes (combined)

From ₱10,000 per taxable year → ₱12,000 per taxable year

These revisions represent both nominal increases and, in some cases, structural changes (such as wage-linked percentages), requiring careful interpretation and implementation.

Practical Implications for Employers

Impact on Total Rewards Strategy

With higher ceilings, organizations may reassess the balance between taxable salary increases and non-taxable benefits. For many employers, particularly those managing large workforces, optimizing benefits within de minimis limits can result in meaningful cost efficiencies while enhancing perceived employee value.

Payroll and Systems Configuration

Payroll systems must be updated to reflect the new ceilings, including automated controls that prevent excess amounts from being inadvertently treated as tax-exempt. Employers operating in multiple regions must also ensure that meal allowances tied to minimum wage are correctly computed based on location.

Policy Documentation and Consistency

Clear internal policies are essential. HR manuals should explicitly define which benefits qualify as de minimis, the applicable limits, and how excess amounts are treated. Consistency in application is a critical defense during audits.

Effectivity: When RR No. 029-2025 Applies

Although RR No. 029-2025 is already issued and final, its enforceability follows the standard rule for Revenue Regulations:

The regulation takes effect fifteen (15) days after publication in the Official Gazette or on the BIR’s official website, whichever comes first.

Until the effectivity date is reached, employers should continue applying the previous ceilings while preparing systems, policies, and communications for transition. Monitoring the publication date is therefore essential.

Retroactivity, Annualization, and Common Areas of Confusion

A frequent concern among payroll and finance teams is whether the regulation requires retroactive payroll adjustments.

As a rule, retroactivity is not required.

Tax regulations in the Philippines apply prospectively unless expressly stated otherwise. RR No. 029-2025 does not mandate recomputation or refund of taxes on benefits already granted before effectivity.

For annualized benefits, timing matters:

- Benefits granted after effectivity may be evaluated using the new ceilings.

- Benefits granted before effectivity should generally be assessed using the old limits.

- For benefits spanning the year, conservative practice is to apply old limits pre-effectivity and new limits thereafter, with clear documentation.

During year-end tax annualization, payroll teams must ensure that only the correct amounts remain excluded from taxable compensation and that any excess is properly classified.

Governance, Compliance, and HR’s Expanding Role

RR No. 029-2025 underscores the reality that HR is no longer merely an administrative function. Decisions on benefits classification, timing, and documentation now sit at the intersection of employee relations, tax compliance, and risk management.

Errors in interpretation can lead to under-withholding, penalties, employee dissatisfaction, and reputational risk. Conversely, well-governed implementation reinforces trust and credibility.

Why RR No. 029-2025 Highlights the Importance of CCBP

Interpreting and operationalizing RR No. 029-2025 requires more than awareness of updated numbers. It demands expertise in compensation structure, tax treatment, policy governance, and employee communication.

This is precisely where the Certified Compensation and Benefits Professional (CCBP) credential becomes critical. Offered by IHRI, the CCBP program equips HR practitioners with the technical rigor and strategic perspective needed to translate regulatory change into compliant, equitable, and sustainable rewards frameworks.

In an era of heightened scrutiny and evolving regulation, CCBP-trained professionals are positioned not just as implementers, but as trusted advisors to leadership.

Conclusion

RR No. 029-2025 represents a timely and necessary recalibration of the Philippine de minimis benefits regime. For HR and business leaders, it is both a compliance mandate and a strategic opportunity to enhance employee value through smarter, tax-efficient benefits design.

Organizations that approach this regulation with clarity, discipline, and foresight will not only remain compliant but also strengthen employee trust and engagement. As always, the true measure of HR leadership lies not merely in applying the rule, but in stewarding it responsibly in service of both people and the business.

This HR Today article forms part of IHRI’s ongoing commitment to providing authoritative, practical, and future-ready insights for HR leaders navigating regulatory change.